Betting on reality: predictions become an asset class

Equity prices bundle hundreds of factors. Prediction markets unbundle them.

On this blog, I have has the tendency to, every now and then, venture out and write about an obscure corner of the capital markets today that could one day matter alot more. Earlier we talked about how fundraising and capital formation may evolve, on the blurring lines between customers and investors, or how emerging technologies like stablecoins might be valuable in the capital markets in the future.

At the start of the month a headline caught my eye: ICE (owner of the New York Stock Exchange, one of the largest stock exchanges) announced a $2bn (!) strategic investment in Polymarket, the largest prediction market. It appears from the press release that ICE wants to own and sell the data signal (read that as live probability curve of real-world events) to the institutional market; banks, funds, corporates, campaigns, and anyone making policy or risk decisions. The news has certainly got a lot more people talking about prediction markets and how their evolution could shift things.

**

I remember a discussion a long time ago with a trader about how oil markets are the best predictor of the possibility of a war in the Middle East. He said that oil markets usually have a great way of pricing future geopolitical risk in the region, way ahead of media and journalists. I asked why “usually”. He said because oil prices have a lot of other dynamics going on for themselves that impact demand and supply, and it is impossible to completely isolate and get exposure to the event of a war breaking out and that oil was simply the best proxy.

**

I also remember, not too long ago, being part of an event where a fund advisor talked about the best way to get exposure to the market in the event of Trump winning the US election in November 2024. The discussion was about buying a bucket of assets today that would likely benefit if Trump won.

**

However, rather than indirectly getting exposure to an event, prediction markets isolate the event, and create what seems to look like a security whose price depends on the crowd’s view of the event taking place.

Here is an example:

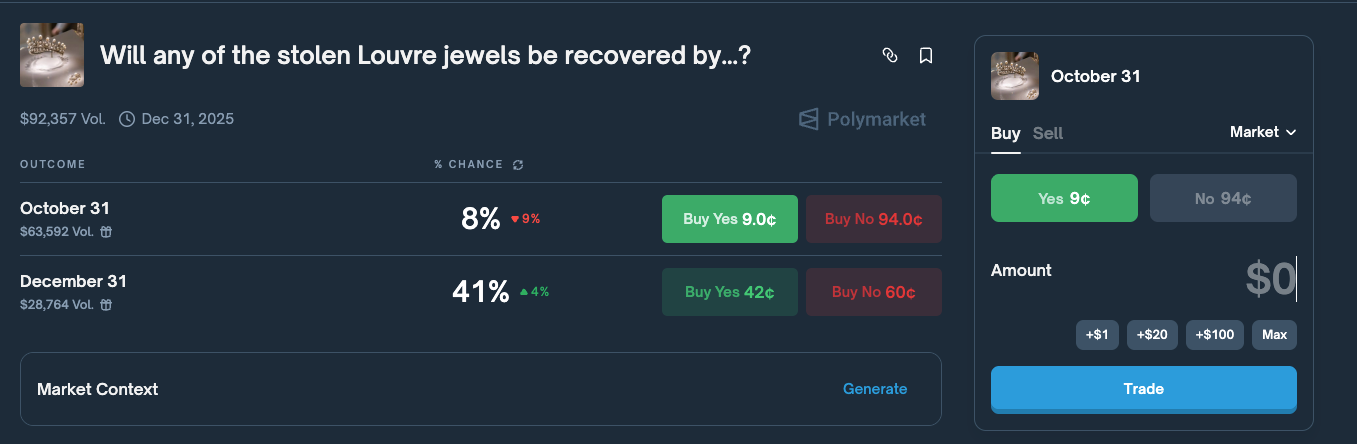

As of today, on Polymarket, there seems to be an 8% chance that the stolen Louvre jewels will be recovered by 31 October and a 41% chance that they will be recovered by the end of the year.

In practice this means, say I have a good idea (say I am an detective in stolen jewels, did my research etc.) that the jewels will be returned by the end of the year - I can buy this contract for $0.42 and wait for the jewels to be found, and then I’ll get $1.00. Of course, the contract might trade up in the lead-up to the event and I can trade out of my contract, like a share, making a profit, or keep it until the end and get the full $1.00.

The current trading price of 42% is the crowd’s consensus view, the view of all the people who have an opinion and have backed it with a financial bet. And by buying a share of the prediction, you own a financial forecast which you might decide to hold until maturity or sell.

And you can also create your own market if you believe there would be enough interest (e.g. will OpenAI launch a piece of hardware by 2025). There are of course all sorts of market design issues to consider: regulation, liquidity, the clarity of the event definition, and whether enough people care to make the signal useful, but the ability to turn a belief into a tradeable forecast is an interesting innovaiton.

This is very different to equity markets, where you are buying an ownership stake in a company and your return depends on its long-term performance and many factors. In prediction markets you are simply trading the likelihood of a specific event, with no ownership or claim on any underlying assets. The goal is not to see through the value in a business, but to price information and expectations as accurately as possible.

It is also very different to traditional betting, where a bookmaker sets the odds and takes the opposite side of your wager. In a prediction market, prices emerge from open trading between participants, so you are betting against other traders and helping the market discover the most accurate probability of the outcome.

So why does this matter, and what is the practical value for companies if this continues to evolve?

Firstly, better forward guidance. Companies could use prediction markets to gather signals on whether investors and employees believe they will actually hit revenue guidance, launch timelines, regulatory approvals, etc. A real-time probability curve becomes a useful tool for management and strategy teams, as well as IR teams to take in feedback from the ‘market’ back to the board room. Perhaps an extreme version of this below, a market for ‘what will Meta say during its next earnings call?"‘

Secondly, better capital allocation and risk management. Instead of relying on external consultants, reserach, internal committees, companies can price the probability of key strategic outcomes even outside of their companies (a refinery opening on time by a competitor, a new product rollout, a clinical trial result) and adjust capital spend ahead based on this data. And risk management especially If liquidity deepens, institutions may hedge exposure through these markets. Imagine a utility or energy company hedging the probability of a nuclear plant approval or a carbon-tax decision.

Thirdly, this could evolve into a new investor-engagement channel, perhaps initially through retail investors. Letting investors back specific milestones and engage in that discussion could deepen loyalty and surface real opinion. It also gives IR teams a clearer way to distinguish between those who are simply trading around short-term noise (best suited for prediction markets) and those who genuinely believe in the company’s direction and want to be long-term partners in the story (best suited for equity markets)!

And finally, on the other side of the table, prediction-market prices could become a valuable signal for analysts and institutional investors. Traditional valuation tries to isolate the probability of specific catalysts; approvals, acquisitions, product launches, but it has always been an estimate buried inside a wider model. If prediction markets provide a clean, constantly updated probability curve for those catalysts, investors can refine positions faster and with more conviction. Suddenly truth about the future becomes its own asset class, and those who price it well gain an advantage.

Of course, this raises all sorts of questions and flags. What stops motivated groups from manipulating the price of certain outcomes? How will regulators categorise event-driven contracts, securities, commodities, or something new entirely? Will companies encourage trading around their milestones? As in other regulated markets, there will be a need for transparency, strong definitions, and guardrails that protect against perverse incentives.However, this is a space that I think will continue evolving, and it is worth paying attention to as it develops.

Equity markets tell you what a company is worth today. The evolving prediction markets are here to tell you what people truly believe will happen next. When we put those two signals side by side the capital formation starts to change shape, and investors can start to separate (and monitise!) short terms hype from long term conviction, companies gain faster feedback loops, and uncertainty becomes something you can price more dircetly. Prediction markets that “trade belief” may one day become just as important as those that trade ownership.