Deep Dive: Digital Securities and Tokenisation Conference 2023

Summaries, slides, transcripts and highlights from this year's key tokenisation event

Opening Keynote by Prof Dr Philipp Sandner

Prof Dr Philipp opened the conference by commenting on the attendees, noticing a trend of punctuality among traditional banking attendees and a tendency for later arrivals among the crypto and web three domain attendees. The conference was noted to be organized by a third party in collaboration with the Blockchain Centre. Despite being held right before the summer holidays, the turnout was impressive, with approximately 250 attendees in-person and 1200 tickets issued for the online event.

Prof Dr Philipp highlighted the shift of focus in this year's conference from crypto to digital securities, mentioning that most of the attendees were from traditional banks and financial service providers. They observed an emerging trend of tokenization and digital securities taking place in Frankfurt, which was reflected in the attendee demographics.

Next, the Prof Dr Philipp pointed out the gaps in the value chain, noting the lack of large scale issuers like Siemens and other corporates and the absence of corporate banks servicing companies for custody carbon tokens. However, they noted that some projects were underway to address these gaps.

The Blockchain Centre, established in 2017, was noted for its dynamism, moving with the changing trends of the ecosystem, from crypto to enterprise blockchains, back to crypto, and now digital securities and carbon tokenization.

He also pointed out a shift in narrative. In the past, the focus was on blockchain technology and shunning crypto, but now, it was on a combination of crypto assets and digital securities. He also mentioned the Digital Euro and CBDCs, indicating that these could solve the DVP problems in digital securities markets. He pointed out that they were expecting carbon tokens to become a hot topic in the coming year.

Discussing legislative work in the field, Prof Dr Philipp mentioned the crypto license laws, the Digital Securities Act, the location act, and the MiCA regulation. They said that as a result of the new rules, businesses were now rushing to get licenses and establish new business models before the enforcement deadline on January 1, 2025.

Prof Dr Philipp finished their opening remarks by giving a brief overview of the history and progress of blockchain technology, pointing out that it started with Bitcoin and then Ethereum, moving through utility tokens and stable coins to security tokens, which they now referred to as digital securities. The future, they said, was full-fledged blockchain solutions or unchained funds. They also gave a snapshot of the impact of the Digital Securities Act in Germany, which has resulted in competition in the value chain.

Key Slides:

Asset Tokenization: From Innovation to Adoption by Michael Duttlinger (Cashlink)

Michael discusses the transition of traditional economies and markets towards a blockchain-based infrastructure, focusing on the domain of tokenisation. The speaker mentions that Cashlink, the company they represent, started its tokenisation process back in 2019 with the first tokenised participation right in Germany. While initially the tokenisation costs were higher and there was uncertainty about the implications of putting security on the blockchain, the speaker indicates that now a clear regulatory framework exists in Germany.

Michael presents Germany as a leading player in the realm of tokenization, boasting progressive and advanced regulations. He notes a shift in the traditional banking sector as more banks begin to embrace this digital transformation. A key example highlighted is Helaba's participation in Cashlink's series A. Despite these changes, the speaker states that the pitch and workings of Cashlink have remained unchanged since its inception.

As tokenisation becomes more mainstream, the speaker mentions that the emphasis is less on the technology and more on its benefits, such as providing access to previously inaccessible assets and enhancing liquidity. The speaker also suggests that tokenisation could potentially bring about cost-cutting and efficiency improvements in financial institutions by eliminating the need for intermediaries and automating processes.

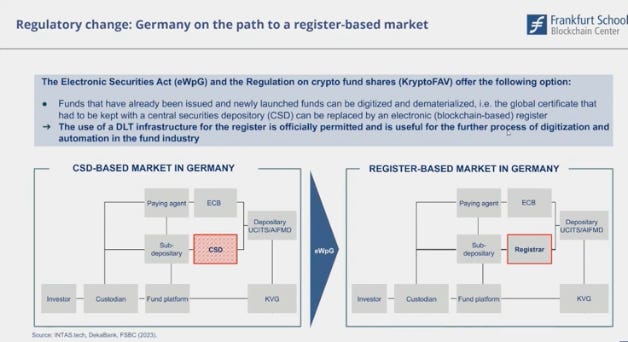

The speaker then highlights how the role of the Central Securities Depository (CSD) is being challenged, leading to increased competition which may drive down costs and stimulate innovation. They also identify a shift from the innovators phase to the early adopter phase of the product lifecycle in the tokenisation market.

Key drivers for wider adoption of tokenised securities are identified as regulatory clarity, improved education, and market infrastructure. Michael noted that other countries are envious of Germany's clear regulatory framework, which provides a solid basis for financial institutions to operate in this space. They argue that the ambiguity in regulations in countries like the US, UK, Singapore, and Japan is a barrier to tokenisation. However, as the market infrastructure continues to evolve, the speaker suggests more roles from the traditional system are being integrated into the new digital capital market infrastructure.

Finally, the Michael comments on the regulatory environment in Germany. They express the importance of the Electronic Securities Act (EWPG) and the crypto custody business in paving the way for broader adoption and providing clear rules and liabilities. They also mention the potential future expansion of regulations to include shares, which would increase the size and diversity of the market. The iterative approach taken by the government is praised, comparing it to the way startups operate. The speaker concludes by mentioning Siemens' large token issuance as an example of the progress being made in this field.

Key Links:

https://www.bafin.de/DE/PublikationenDaten/Datenbanken/Kryptowertpapiere/kryptowerte_node.html

Key slides:

Is Europe Now Becoming Crypto Valley by Dr Stefan Berger (European Parliament)

Dr. Stefan Berger begins by expressing his gratitude for the invitation to speak at the conference and commends the organizers for assembling an excellent lineup of experts and participants. He highlights his involvement as the responsible reporter for the Markets in Crypto Assets (MiCA) regulation in the European Parliament.

He explains that after nearly two and a half years of negotiations, an agreement was reached between the European Parliament and the 27 member states of the European Union. MiCA was published in the official journal of the EU and has already come into force, with certain provisions becoming applicable in one year and the entire regulation in full force at the end of December 2024.

Dr. Berger provides an overview of MiCA, which classifies crypto assets into three categories such as e-money tokens, asset reference tokens, and utility tokens. He emphasizes that MiCA does not touch Bitcoin or Ethereum, as it is future-oriented and cannot be applied retroactively. MiCA mandates that all coins need a white paper containing specific information about the issuer, rights and obligations attached to the asset, underlying technology, reserve assets, and environmental impact, among other details.

The regulation also introduces capital requirements for issuers of crypto assets, aiming to level the playing field between traditional financial institutions and crypto asset providers. Additionally, an authorization process is established to ensure the business models of new tokens do not endanger monetary stability. Significant tokens fall under supervision architecture, with national competent authorities and the European Banking Association being responsible for supervision.

Dr. Berger mentions the debate over environmental safeguards but notes that a solution was found without introducing new bans. Instead, issuers must comply with extensive disclosure requirements related to energy consumption and environmental effects. The regulation also addresses anti-money laundering concerns.

In conclusion, Dr. Berger believes that MiCA was a good step in the right direction, providing a framework for the development of crypto assets. He emphasizes the importance of trust in the crypto space and believes that Europe has the potential to become a "Crypto Valley" with a solid regulatory framework like MiCA. He advocates for a global approach to crypto regulation and encourages the audience to seize the opportunities presented by the framework to build trust and drive innovation in the crypto space.

Summary: Asset Agnostic Token Issuance & Lifecycle Management by Radoslav Albrecht (Bitbond)

Radoslav Albrech, the founder and CEO of Bitbond, a provider of tokenization technology, speech explored the topic of asset-agnostic token issuance and lifecycle management. Bitbond's software has facilitated the creation of over 1,000 different tokens.

Radoslav explained that tokenization offers benefits such as paperless proof of ownership, instantaneous global value transfer, and enhanced lifecycle management through programmable payments. He referenced a study by the World Economic Forum and BCG, predicting that approximately $16 trillion worth of assets will be tokenized by 2030, representing about 10% of the projected global GDP.

While the current total value of tokenized assets stands around $300 billion, the speaker expressed confidence in the growth of this sector, mentioning that essentially anything of value could be tokenized by a range of entities, from financial institutions to SMEs, corporations, and web3-native users and companies.

In order to achieve the projected $16 trillion worth of tokenized assets, Radoslav acknowledged there are challenges to overcome. These include the asset-specific components in the tokenization process, the diversity of issuers, regulatory frameworks in different jurisdictions, and varying tech stacks used by issuers.

However, he pointed out the standardisable tech infrastructure components, such as key custody infrastructure and tokenisation infrastructure, that can be applied across different asset classes, which is the good news. He mentioned that most tokenization activity is happening on a few dominant Ethereum-compatible (EVM) blockchains.

Radoslav discusses the concept of asset agnostic infrastructure and its application in the financial industry. Currently, various asset classes like bonds, certificates, and loans are managed separately in silos with different technological infrastructures and settlement systems. The speaker proposes a shift towards a more universal asset infrastructure that unifies these processes. They introduce three layers to achieve this: the core banking layer (which remains unchanged), the key custody layer, and the tokenization technology layer.

The speaker talks about Token Tool from Bitbond as a product that facilitates the creation, configuration, and management of tokens across different asset classes in a unified manner. The tool supports various token standards like ERC 20 (fungible permissionless tokens), ERC 1400 (fungible permission tokens with compliance capabilities), and ERC 721 (NFTs).

The discussion moved to the lifecycle of tokenization, which includes automated processes such as token distribution, delivery versus payment (DVP) through smart contracts, managing lockup periods, minting and burning tokens, automating payments (e.g., recurring coupons), and compliance functions like whitelisting.

Radoslav presents examples of tokenised assets, such as gold, collectibles, and utility tokens for a music platform, all achieved through Token Tool and a key custody layer. Despite the diversity of assets and legal structures, the unified infrastructure enables streamlined issuance processes.

In conclusion, the speaker emphasizes the importance of not reinventing the wheel and using existing components for token issuance and management. They suggest tailoring only what is necessary, focusing on standardization, and capturing economies of scale through ready-made components. By tokenizing certain asset classes first, an organization can quickly realize cost benefits and then expand to other asset classes using the established infrastructure.

Key Links:

Key slides

Summary: Exploring Tokenization Possibilities with DeFi by Kasper Luyckx (Crypto Finance)

Kasper Luyckx, the head of product at Crypto Finance, starts by introducing the concept of DeFi (Decentralized Finance), an unregulated financial system on open public blockchains that aims to provide an open and fair financial ecosystem without intermediaries and friction. He explains that understanding DeFi's innovation can help banks and institutions unlock value when digitizing financial instruments and issuing them on the blockchain.

He briefly introduces Crypto Finance, a company acquired by Deutsche Borse in 2021 and regulated by FINMA in Switzerland. The company offers a wide range of crypto-related services, including brokerage, custody, staking, and investment in digital assets through traditional structures like ETPs and funds.

Kasper then focuses on the company's tokenization platform, which guides clients through the entire lifecycle of tokenized assets. The platform supports various product types and ERC standards and allows easy deployment and management of smart contracts. The offering includes human intervention, approval frameworks, and gas fee management, leveraging the company's existing crypto backend and security solutions.

He concludes by emphasizing the platform's value proposition, particularly its wide product support, easy access, quick time to market, and high-security standards, making it a suitable solution for banks and institutions looking to tokenize financial assets.

Kasper continues his speech with an exploration of key concepts in DeFi. He starts by reiterating the objective of moving towards a DLT system, which is to create a decentralized and interconnected network, eliminating the need for central intermediaries.

He introduces the concept of modular and composable finance in DeFi, where anyone can issue tokens and custody them easily on the same network using standardized protocols. Transferring assets between custodians becomes seamless through blockchain transactions, and assets can be listed and traded on various exchanges without the need for extensive technical integration.

Kasper then discusses the concept of "money Legos" in DeFi, where different protocols can interact and build on each other seamlessly. He illustrates this with an example where an individual stakes Ethereum, receives stake ETH as a receipt, uses it as collateral to get a loan in stablecoin from a lending protocol, provides the stablecoin as liquidity on an exchange, and continues the process with other protocols. This frictionless interaction between different protocols is made possible because they all use the same standard and can communicate peer-to-peer on the blockchain network.

Kasper encourages the audience to explore DeFi and experience firsthand the innovative and seamless capabilities it offers through its modular and composable financial system. He emphasised the magical and frictionless experience of DeFi, where the combinations and interactions between different protocols are exponential. He highlights the growth drivers of DeFi, such as standardization, open and permissionless nature, 24/7 availability, transparency, and the use of stablecoins.

He presents data from DeFi Lama, showcasing the size and categories of various DeFi protocols, with Ethereum and layer-two solutions being the primary networks for DeFi activity. Liquid staking emerges as a significant category due to the transition from proof of work to proof of stake in Ethereum. Kasper acknowledges that while DeFi has grown rapidly, there are still limitations, including regulatory challenges and scalability, but he believes these issues will be addressed in due course.

Casper explores how the security value chain can be rethought with DeFi, where companies, banks, or individuals can directly issue tokens on the blockchain network, enabling self-custody of assets. Liquidity pools can be created for 24/7 trading, and automated executions can distribute dividends to token holders. He briefly mentions a permissioned version of a lending platform and discusses Maple Finance's approach, which represents traditional treasuries on-chain, offering efficient asset conversion without relying on the traditional financial system.

Key slides

Panel Discussion - Unleash Digital Securities Regulation in Germany and Beyond

The conference panel discussed various aspects of digital securities and the new German regulation surrounding them. The panel consisted of individuals from different financial institutions and consulting firms. They touched on topics such as tokenization of assets, the challenges of standardization, and the potential for blockchain-based infrastructure in the financial industry. Here are the key points discussed by each panelist:

Sandra Sohn moderated the discussion, which focused on the new German regulation regarding digital securities and crypto fund units. The participants highlighted various pain points and challenges for financial institutions in adopting blockchain-based infrastructure, particularly in terms of standardization, technology integration, and the uncertain regulatory environment.

They discussed the need for more harmonization at the European level and the challenges in achieving standardization in the security token space. Some participants emphasized the importance of being convinced about the potential of blockchain-based solutions and the necessity of long-term commitment and endurance for successful implementation. The lack of clarity in regulations and the uncertainty of the market were also noted as hindrances to adoption.

Regarding opportunities in the space, participants saw the chance to shape the market early on and to gain expertise in the emerging technology. However, they acknowledged that becoming a registrar or custodian in the crypto space might not necessarily be a highly profitable business due to competition and the need for a wider European market. They emphasized the importance of creating solutions that work and provide real value to customers.

Overall, the panel discussion highlighted the complexities and challenges surrounding the adoption of digital securities and blockchain technology in the financial industry, while also recognizing the potential for transformation and growth in the future.

In the second part of the panel discussion, the participants discussed the importance of taking opportunities seriously and not underestimating the potential of blockchain-based infrastructure and digital assets. They used the example of electric cars to illustrate how early dismissal of new technologies can lead to missed opportunities and high opportunity costs. They emphasized the need for innovation and creativity in the financial industry to discover new products and solutions that can drive mass adoption.

When asked about the critical missing piece for mass adoption in the space of digitization and blockchain-based infrastructure, the participants highlighted several factors. Some mentioned the importance of wholesale Central Bank Digital Currencies (CBDCs) to complement the digital asset space and provide cash settlement on the blockchain. Others emphasised the need for liquid secondary markets to enhance accessibility and facilitate trading of digital assets. Additionally, participants stressed the importance of educating and providing information to investors about the potential benefits and business cases of blockchain-based solutions to foster wider adoption.

Overall, the discussion underscored the transformative potential of blockchain technology in the financial industry but also highlighted the need for regulatory clarity, standardization, and broad market participation to drive mass adoption and realize its full benefits

Summary: Digital Asset Rails: How to build the Future of Financial Markets

The panel discussed the importance of tokenization and how it offers opportunities for various industries. Tokenization is seen as a way to digitize assets and create more efficient and flexible products.

The tokenization market is still in its early stages, with many projects being in the proof-of-concept (POC) phase. However, some real use cases and successful implementations already exist.

Natively digital assets, which are assets specifically designed for the digital environment, are seen as a game-changer. They offer unique features and interactions that traditional assets cannot provide.

Building proper infrastructure, including key management and security measures, is crucial for successful tokenization projects. The focus is on integrating new technology with existing systems.

Differentiating between cryptocurrencies, tokenized money, and tokenized securities is important when considering investment strategies. Institutional investors are showing interest in cryptocurrencies and tokenized securities, but the market is still at a relatively early stage.

Asset custody is a critical aspect of digital asset management. Blockchain technology offers the potential for instant settlement and increased efficiency, but it also requires careful integration with existing infrastructure to achieve the desired benefits.

Education and finding the right talent with a combination of knowledge in traditional finance and blockchain technology are challenging. Partnerships between traditional finance companies and digital asset-native companies are seen as a way to bridge the knowledge gap.

The panelists discussed the need to grow the digital asset market by including new participants, such as SMEs, that may have been excluded from traditional capital markets.

The evolution of the workforce in the blockchain and crypto industry was highlighted. Initially, most employees were enthusiasts with deep technical knowledge, but as the industry grows, a diverse set of skills and interests is required for further expansion.

Overall, the panel emphasized the potential of tokenization and blockchain technology to revolutionize various industries, but it also acknowledged the challenges in building the necessary infrastructure and finding the right talent. Partnerships and collaboration between different players in the space were seen as essential for driving further adoption and growth.

The panel discussion covered various aspects of blockchain technology, tokenization, and its implications on the financial industry. The participants discussed the importance of understanding the technology and infrastructure layer of blockchain, even if not everyone may comprehend the cryptographic aspects. It was emphasized that operational solutions need to provide a user-friendly policy management layer for employees to operate blockchain infrastructure efficiently.

Regarding education in the blockchain space, DWS, mentioned the creation of a Digital Asset Academy within their organization. The academy aims to educate internal employees about blockchain, digital assets, tokenization, and related topics. The goal is to ensure that everyone within the organization understands the potential and challenges of the technology to develop and distribute blockchain-based products to clients.

The discussion also touched on the balance between transparency and privacy in the context of blockchain and digital asset rails. While public blockchains offer transparency, there are concerns about revealing sensitive information and IP, especially for regulated financial products. The need for different levels of transparency, depending on the use case, was highlighted.

The role of policymakers and regulators in tokenization was deemed essential, and Germany was praised for having specific legislation focused on tokenizing securities. However, it was also noted that there is room for improvement in coordinating efforts and scaling adoption of the existing regulatory frameworks.

The topic of "direct indexing" and whether investors might choose to invest directly in tokenized assets instead of using a fund wrapper was also discussed. The potential for direct indexing in the future was acknowledged, but the added value of fund wrappers in terms of professional portfolio management and investment strategy was highlighted.

Regarding asset classes for tokenization, money markets were mentioned as the easiest to start with, while others suggested exploring illiquid assets, customized solutions, and coordinating efforts to focus on a particular asset class for mass adoption.

Overall, the panel discussion shed light on various perspectives and challenges in the blockchain and tokenization space, emphasizing the importance of education, regulation, and collaboration for the successful integration of blockchain technology in the financial industry.

Summary: Panel Discussion - Tokenization of New Assets Music Rights, Real Estate, Carbon, Cars, etc.

The first part of the panel speech involved an introduction by Sarah Gottwald, followed by brief introductions from other panelists: Nadine Wilke from Particula, Enno Henkel from Heartstocks, Lukas Zaehringer from Blocksize, and Michael Spitz from 360X. They discussed the advantages of tokenizing real-world assets, such as increased liquidity, transparency, and reduced intermediaries. However, they also acknowledged challenges in creating secondary markets and gaining mass adoption.

The panelists highlighted that tokenization is not a one-size-fits-all solution and requires consideration of the specific industry and asset being tokenized. They mentioned examples of tokenizing commodities like copper and cobalt, as well as assets in industries like art and music. They also discussed the importance of finding a balance between the needs of capital market professionals and industry participants when applying tokenization.

The discussion touched upon the evolving nature of marketplaces and the need to create new infrastructures for certain assets, such as the voluntary carbon market, which previously lacked a formal marketplace.

In summary, the first part of the panel focused on the benefits and challenges of tokenizing real-world assets, with an emphasis on the need for industry-specific considerations and the development of appropriate market infrastructures. The panelists brought different perspectives from their respective companies and industries to enrich the discussion.

In this discussion, the participants talk about tokenization and its potential impact on various industries. They focus on how tokenization can be used to link assets to sustainability goals, particularly in the context of climate change and the mobilization of financial resources for the net-zero transition. They highlight the importance of reliable and verified data underlying financial instruments related to ESG ratings and green bonds, as well as the need for new digital infrastructure to address issues like greenwashing and supply chain due diligence.

The panelists discuss different use cases for tokenization, such as in the art, music, and real estate markets. They point out that tokenization can enable increased accessibility and liquidity in these markets, allowing small investors to participate in assets that were previously unobtainable. However, they also emphasize the need for caution and regulation to ensure that investors fully understand the risks involved when investing in tokenized assets.

The discussion touches upon challenges related to tokenization, including regulatory hurdles and the need to educate both investors and regulators about the new technology. They also address concerns about the potential for tokenization to lead to market meltdowns similar to the FTX incident, where assets were not adequately backed by real-world value.

In conclusion, the participants acknowledge the challenges and uncertainties surrounding tokenization but express optimism about its potential to create value and increase efficiency in various industries when implemented responsibly and with proper regulation and oversight.

Summary: Panel Discussion Building Ecosystems for Cross Border Digital Assets

The panel discussion on "Building Ecosystems for Cross Border Digital Assets" covered a range of themes related to tokenization and blockchain technology. Participants discussed the challenges and opportunities of adopting tokenization in traditional financial organizations.

They highlighted the importance of collaboration and regulatory compliance to promote the adoption of blockchain and tokenization technologies.

The concept of the commercial bank money token was introduced, enabling industry companies to have direct access to money on their blockchains for efficient payment processes. Discussions also revolved around tokenized bank deposits, a form of tokenization that improves efficiency and anti-money laundering practices while adhering to established best practices and regulatory standards.

The role of banks in the tokenization ecosystem was emphasized, given their significance in providing infrastructure and security. However, challenges such as the need for secure systems, singleness of money, and compliance with regulations were also recognized.

Regulators discussed their efforts to monitor innovation and tokenization projects in the banking and payment sector. They highlighted upcoming work on decentralized finance and crypto lending in response to regulatory requirements.

Overall, the panel emphasized the potential of tokenization to transform the financial sector but also acknowledged the importance of addressing challenges and collaborating effectively across industries to realize its full potential.

Links:

Panel Discussion - What Transactions in Asset Management Are Next for Institutional Adoption?

The first part of the conference speeches focused on the topic of investor preferences and how tokenization is impacting the financial landscape. The panel consisted of several participants, including representatives from financial institutions and asset management firms.

Philipp Sandner, from FS Blockchain Centre, introduced the discussion by highlighting the significance of investor profiles and the impact of tokenization on meeting future investor demands. The panel explored various tokenization projects, including those related to private markets, loans, bonds, and crypto assets.

Valerie Noel, from SYZ Group, emphasized the importance of trust and safety in the crypto space, particularly after incidents like FTX. Investors are seeking both alpha (high returns) and safety in their investments.

Matthew Low, from Fansanara Capital, discussed their firm's involvement in private credit funds and high-frequency trading of digital assets. They are exploring tokenization to offer investors more optionality and are emphasizing due diligence on the underlying assets to build investor confidence.

Christoph Hawk, from Union Investment, stressed the significance of fulfilling investor trust and performance expectations. He highlighted the need for a robust regulatory environment and the importance of creating efficiencies and additional alpha through tokenization.

Christian Schmidt, from ABN Amro, talked about their efforts to tokenize assets and the potential of tokenized assets to become important financial instruments in the future.

Rajeev Bamra, from Moody's, mentioned their focus on understanding digital risk exposures and the role of native digital assets in the evolving digital finance ecosystem.

The discussion revealed that investors are looking for trust, safety, alpha, and performance in their investments. Tokenization offers benefits such as increased accessibility, liquidity, and cost mitigation, which can attract more investors and streamline processes in the financial markets. The panelists also highlighted the importance of due diligence and track records to build investor confidence in tokenized assets.

Rajeev Bamra from Moody's highlighted the potential of tokenization in private markets. He emphasized that investors are not just changing their preferences; rather, they are seeking more access to illiquid assets with higher potential returns compared to liquid assets. Tokenizing illiquid assets on the blockchain can provide fractional ownership, increase liquidity, and enable a larger pool of investors, including retail investors, to access asset classes that were previously limited to institutional investors. Despite challenging economic conditions, the demand for private capital has remained strong, and the global assets under management are projected to nearly double to about $18 trillion by 2027.

The panel then discussed how tokenisation is not just about gaining efficiencies for existing products but also about democratising access to new asset classes for retail clients. Tokenization opens up opportunities for retail investors to invest in previously inaccessible assets through fractionalisation, which can be offered through monthly savings plans, making investing more accessible and flexible for retail clients.

Valerie Noel from SYZ Group mentioned that younger generations are eager to participate in finance and crypto assets. The smartphone generation is looking for quick and accessible tools to invest, and tokenisation can offer them a new way to access various assets.

The panelists agreed that both retail and institutional investors are showing interest in tokenisation. Retail investors seek diversification, while institutional investors are intrigued by the potential efficiencies and benefits that tokenisation can offer. The combination of both retail and institutional interest is driving the growth of tokenisation in the financial industry.

The impact of inflation and the changing regulatory landscape were also discussed. The increase in inflation triggered individuals to seek alternative investment possibilities, including digital assets and crypto. The panelists mentioned that regulation plays a key role in building trust and attracting institutional investors to the digital asset space. In this context, the European market is perceived as being more advanced in terms of regulations compared to the US.

In conclusion, the panel acknowledged that tokenisation is causing a shift in investor behaviour, as it presents new investment opportunities and challenges traditional investment paradigms. The rise of regulated entities and the decoupling of digital assets from cryptocurrencies are seen as positive signs for the industry's growth and stability.

Panel Discussion Digital Financial Instruments: What’s Next?

The panel discussion began with the participants introducing themselves and their respective organizations. They discussed their involvement in various tokenization projects and the challenges faced in implementing them. Philipp Sandner from FS Blockchain Centre moderated the panel.

Ramin Ghafari from Siemens talked about his experience with blockchain and DLT projects within their treasury organization over the past five years, including involvement in tokenization projects.

Benjamin Duve from BNY Mellon highlighted his role as a custodian and their interest in exploring opportunities related to digital assets and blockchain technology.

Marion Spielmann from DEKA bank expressed his goal to build the digital asset value chain for their clients and emphasizes the importance of collaboration and open platforms in the tokenization space.

Chris Jones from HSBC talked about their interest in digital assets and blockchain technology, with a focus on removing friction and enhancing services for their clients.

Ralf Kubli, associated with the CASPER Association and Nucleus Finance, provided insights into their work related to financial instrument infrastructure based on the ACTUS standard.

The discussion moved to specific tokenization projects, with Amin discussing their crypto bond issued in February and other projects involving alternative financing and NFTs. Another panelist mentions a sizable asset-backed securities project, where the need for granular securitization is explored.

Marion Spielmann talked about DEKA bank's platform and the decision to make it an open platform to encourage collaboration and standardisation within the market.

Chris Jones shares lessons learned from their project, emphasising the importance of internal education for stakeholders and the challenges of integrating digital assets into the legacy financial system.

The panel concluded with an agreement to discuss the identified factors necessary for scaling tokenisation further in the future.

In the second part of the panel discussion, the participants delve into the next hurdles to solve in the tokenisation space. They emphasised the importance of addressing liquidity and secondary market challenges to create a seamless and integrated market for digital assets.

The discussion centerer around the need for a client-driven perspective, ensuring that clients can interact with tokenised assets as easily as they do with traditional assets. Fragmentation and lack of interoperability between different platforms are highlighted as obstacles to achieving liquidity in the tokenised asset market.

Benjamin Duve emphasised the importance of working with existing pools of liquidity and leveraging the strengths of traditional financial systems while adopting innovative technology solutions.

Ralf Kubli presented a more conceptual view, stressing the importance of avoiding a situation similar to the 2008 financial crisis, where assets and obligations lacked clear definitions. He proposes using machine-readable and machine-executable standards, such as the open-source ACTUS standard, to ensure uniform and clear descriptions of financial assets.

The discussion also touched upon the topic of standards, with Marion Spielmann being asked to share insights. However, the summary does not provide specific details about her response.

The panel concluded with an acknowledgment of the need for collaboration and standardisation in the tokenisation space to overcome challenges and achieve widespread adoption of digital assets.

In the third and final part of the panel discussion, the participants explored the topic of the "P" part of DVP (Delivery versus Payment) - the payments aspect and the role of central bank digital currencies (CBDCs) and other solutions in facilitating transactions.

Ramin Ghafari from Siemens emphasised the need for programmable money and programmable payments, especially for small and frequent cash flows in corporate operations. He believes that if the ECB or other central banks cannot provide a suitable solution, there is a significant need for alternative trustworthy solutions to cater to these requirements.

Benjamin Duve from BNY Mellon suggested that the industry should focus on wholesale CBDC (central bank digital currency) rather than retail CBDC. Wholesale CBDC would serve large volume payments for Treasury operations and settle transactions between financial institutions.

The panelists discussed the importance of building standards in the tokenisation space to create reliance and trust among investors and issuers. They agree that a standard for describing the cash flows of financial assets is crucial to avoid fragmentation and ensure interoperability.

Regarding the use of public blockchain systems like Polygon, the participants shared their experiences, with Siemens using Polygon for retail experiments and institutions opting for private blockchain solutions for institutional bond issuance.

The conversation then shifted to the topic of the "P" part of DVP and the challenges in bringing the Euro into digital asset systems. The panelists agree that central bank money will be needed as an option in the future, especially for large-volume transactions, but the immediate need for corporate digital Euro solutions may not be pressing due to the current volume of transactions.

There is no clear solution or roadmap for the payments aspect, and the discussion concludes with the understanding that further exploration and industry collaboration are necessary to address this aspect in the future.

The panel discussion touched on various aspects of the tokenisation space, including liquidity, standardisation, and the role of central bank digital currencies, shedding light on the complexities and opportunities in this evolving domain.

Disclaimer: Above are personal notes and there may be significant errors, typos, omissions in this document.