Training Investors as ‘Students’ of the Companies They Invest In

Point72’s philosophy about creating a learning curriculum for investors

A few years ago, IR Magazine interviewed Harry Schwefel, the Co-Chief Investment Officer at Point72, a large Boston-based hedge fund. For some reason this interview has stuck with me, and I have found myself bringing it up in many client meetings in the context of discussing company-organised investor events.

Point72 runs a multi-manager platform model, which effectively means there are dozens of independent teams running different strategies while risk management, reporting and compliance are centralised. The strategies also involve traditional stock-picking models across emerging markets, where we often come across this fund.

In his interview (transcript here), Harry mentioned a number of times that the investment professionals in his firm are long-term students of the companies they invest in:

We’ve built this model of really training investors to be students of the business, we’ve tried to give our investment professionals more time […] to obsess over what we know about the company, where they’re trying to go, and the industry. Focusing on getting the direction right over the next few years, rather than obsessing over the next quarter or the next tick.

Firstly, it is refreshing to hear a CIO of a prominent hedge fund publicly advocating such a long-term approach to investing: giving his portfolio managers ample time to study companies deeply, knowing the industry, supply chains, customers, competitors, and especially management quality.

Secondly, if portfolio managers act as long-term students, company investor relations teams can be a very valuable asset in this process by creating a “curriculum” of events for those investors.

In practice, this means combining various activities together, presented by different internal teams in the company, and grouping them together as a coherent programme for a captive audience.

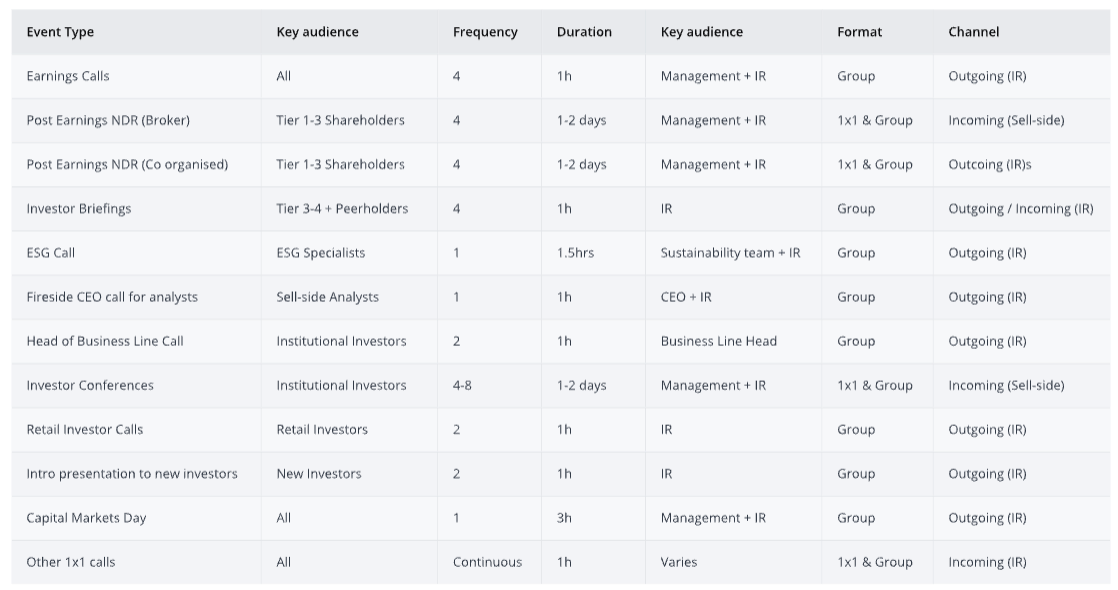

I have seen many examples of this from companies, and the graphic below tries to show a few examples of company-organised events that could eventually form as a year-long curriculum.

I have also seen good examples of companies proactively pointing investors to credible outside industry resources, publications, or events where investors can learn more about the sectors they operate it. The idea is not to sell the story, just make the investor as comfortable and as knowledgable as possible.

In reality, it is a logistical challenge to organise so many events, and even more complicated to tailor the content for different “students,” each at a different stage of their learning journey.

However, with AI increasingly embedded into the workplace, it will become much easier to personalise each aspect of the investment case and address the specific needs of investors, drawing on what we know about them, their history of interactions with us, and previous lines of questioning.

One way to look at investor engagement is not as a calendar of isolated, siloed events, but as a continuous, adaptive curriculum, a journey that begins with the first call or introductory meeting and ending in an investor becoming a long-term shareholder in your business.